A dividend calculator is an essential financial tool, specifically designed to help you understand how your investments can grow over time through the power of dividend reinvestment. By using this calculator, you can predict the future value of your dividend stocks, which is extremely useful in planning your financial future and potential retirement income. The tool uses specific variables such as initial investment, dividend rate, dividend reinvestment, and duration of investment to provide a comprehensive picture of the potential growth of your funds.

It is an invaluable resource for individuals who are investing in dividend-paying stocks, as it allows them to visualize the exponential growth that can occur over time. This comprehensive guide will teach you how to effectively use a dividend calculator, interpret its results, and apply this knowledge to your investment strategy. It will also delve into details such as the importance of dividend reinvestment, the impact of different dividend rates, and the long-term effects of compounding dividends. Understanding these details can greatly enhance your ability to make informed investment decisions and achieve financial security.

Step-by-Step Guide to Using Our Dividend Calculator

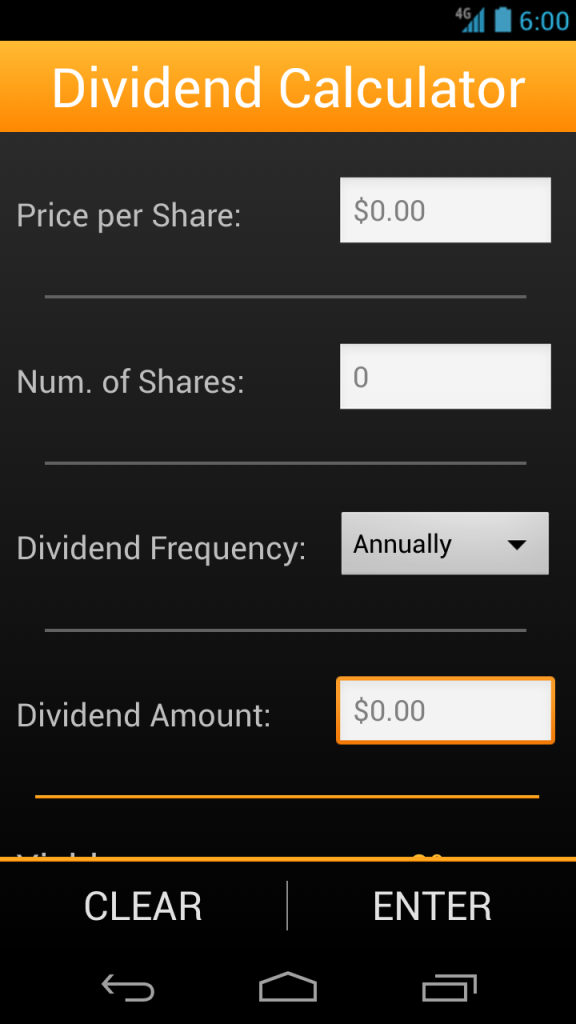

Our dividend calculator is designed to aid in accurate calculation of dividends that you are expected to earn on your investments. This user-friendly tool is easy to operate and provides instant results. To start using it, first, you need to input the amount of your initial investment. This could be the total amount you have invested in a company’s stocks. Next, you need to input the dividend yield. This percentage represents the ratio of the annual dividend compared to the stock’s current market price. Then, you would need to enter the growth rate. This percentage is an estimated annual increase in the dividend payment. Once you have input all the necessary details, the calculator will give you the total dividends you would earn over a specified period.

You can also adjust the time period to see how your dividends would grow over different intervals. The calculator also provides an option to reinvest the dividends. If you choose to reinact this option, it will show you how the reinvested dividends would impact your total returns. It’s important to remember that the numbers shown by the calculator are estimates and actual returns may vary. This tool is meant to provide you with a general idea of your potential returns and help you make informed investment decisions. The calculations are based on the data you input, so make sure the information is as accurate as possible for a more precise result. Hence, our dividend calculator serves as an effective resource for investors seeking to understand their potential dividend income.

Understanding Dividends: A Basic Overview

Dividends are a portion of a company’s earnings that are distributed to shareholders, typically in the form of cash or additional shares of stock. They are essentially a reward for investing in the company and are typically paid out on a regular basis, such as quarterly, semi-annually, or annually. The decision to distribute dividends is made by a company’s board of directors and can be influenced by a variety of factors, including the company’s current profitability, future growth prospects, and cash flow situation.

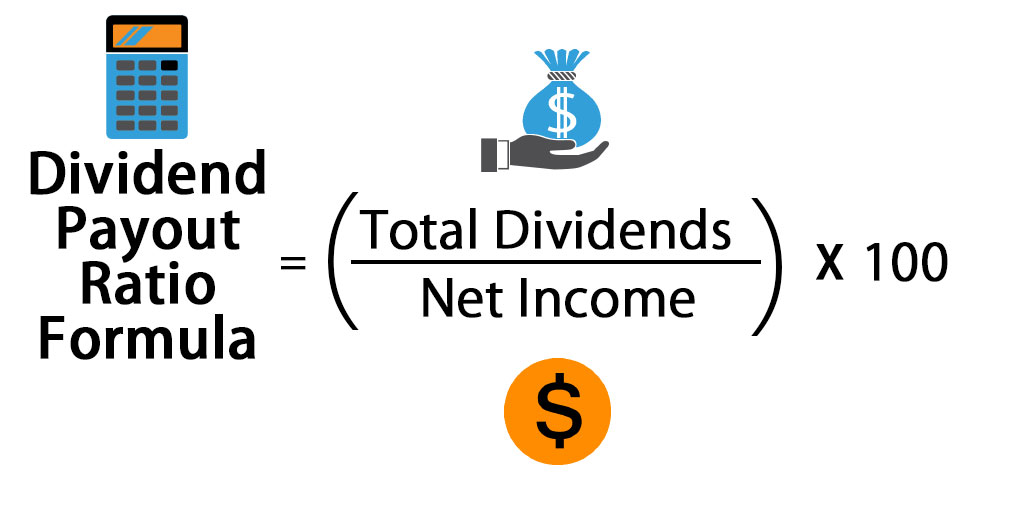

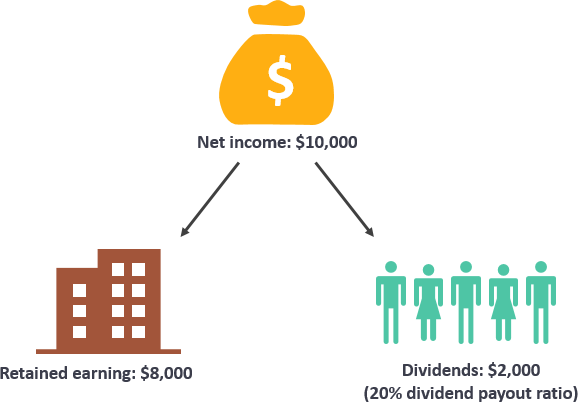

There are two key terms related to dividends that investors should understand: dividend yield and the payout ratio. Dividend yield is the annual dividend payment divided by the stock’s current market price, represented as a percentage. It provides an indication of the income an investment will generate in relation to its price. Payout ratio, on the other hand, is the proportion of earnings paid out as dividends to shareholders. It helps investors understand a company’s ability to sustain its dividend payments.

Investors with a preference for income-generating investments often seek out companies with a consistent history of paying dividends. These companies are typically stable, mature, and operate in established industries. However, not all companies pay dividends, especially those in growth industries or in early stages of development. Instead, these companies might reinvest their earnings back into the business to fuel growth and expansion.

Dividends should not be the only factor considered when investing in a company’s stock. While they can provide a steady stream of income, they do not guarantee overall investment returns. It is crucial to consider a company’s overall financial health, growth prospects, and the price you are paying for the stock. Understanding dividends is a fundamental aspect of investing and can help investors make more informed decisions about where to allocate their capital.

What Is Dividend Yield?

Dividend yield is a financial ratio that signifies the annual dividend payment a shareholder receives relative to the market price of the stock. Essentially, it is a measure of the income generated by an investment in a particular stock. It is expressed as a percentage and calculated by dividing the annual dividend payment by the current price of the stock. For instance, if a company issues a dividend of $2 per share and the current market price of the stock is $50, the dividend yield would be 4%.

This gives potential investors a sense of the cash flow they will receive for each dollar invested. Therefore, a higher dividend yield can be appealing to investors looking for regular income from their investments, such as retirees. Conversely, a lower yield may signify that the company is reinvesting its profits into business growth rather than returning them to shareholders. It is important to note, however, that a high yield may not always be beneficial as it could indicate financial instability within the company. Therefore, investors should not rely solely on dividend yield when evaluating investment opportunities but consider it in conjunction with other financial metrics and indicators.

The Importance of Dividend Yield

Dividend yield plays a crucial role in investment decision-making and is considered a significant factor for investors seeking regular income. It is a financial ratio that indicates the percentage of a company’s annual dividend relative to its share price. The higher the dividend yield, the more an investor earns for every dollar invested in a company’s stocks, making it an attractive proposition for income-focused investors.

Moreover, the dividend yield can become a tool for evaluating the profitability of a company. A higher yield can indicate a company’s strong financial status and its ability to generate consistent profits. This could make it a more stable and less risky investment choice. However, a very high yield might not always be a positive sign as it could also suggest that the company is facing financial distress and is trying to maintain a semblance of health by distributing higher dividends.

Furthermore, the dividend yield can also help investors compare the potential returns from different companies. By comparing dividend yields, investors can identify which stocks will potentially give them the highest income. This can be particularly useful for retirees or other investors who rely on their investments for regular income.

It’s worth noting that while the dividend yield is an essential tool for evaluating investment opportunities, it should not be the only factor taken into consideration. Other aspects such as the company’s growth prospects, industry position, and overall economic conditions should also be factored into an investor’s decision-making process. Hence, the dividend yield, while significant, should be seen as a part of a broader analytical toolkit, helping to build a comprehensive picture of a company’s performance and potential return on investment.

Dividend Payment Schedules: When Are They Paid?

Dividend payment schedules refer to the timeline or plan by which a corporation distributes dividends, or portions of its profits, to its shareholders. The schedule or frequency of these payments can vary greatly depending on the company’s policies and financial situation. Some companies may choose to pay dividends annually, semi-annually, quarterly, or even monthly.

The dividend payment process typically involves several important dates. Firstly, the declaration date is when the company’s board of directors announces its intention to pay a dividend. Following this, the ex-dividend date is the deadline by which an investor must own shares to be eligible for the upcoming dividend payment. In other words, if an investor buys shares on or after this date, they will not receive the next dividend.

Next, the record date is the day when the company reviews its records to determine who its shareholders are, and thus who will receive the dividend. This date usually falls a couple of days after the ex-dividend date.

Finally, the payment date is when the dividend is actually distributed to the shareholders. The time between the declaration date and the payment date can vary, but it is typically a few weeks to a few months.

In summary, dividend payment schedules can differ greatly among different companies, and there are several key dates to be aware of in the dividend payment process. However, regardless of the specific schedule, the common thread is that dividends are a way for companies to share their profits with their shareholders, rewarding them for their investment in the company. The regular receipt of dividends can provide a steady income stream for shareholders, especially for those who hold a significant amount of shares in dividend-paying companies. Therefore, understanding how dividend payment schedules work can be a crucial aspect of investment decision-making.

Exploring Dividend Stocks: An Introduction

Diving into the world of investing, individuals often encounter a variety of investment opportunities, among which dividend stocks hold a significant position. When a company earns profits, it has the choice to reinvest these funds into the business or distribute a portion of it among their shareholders in the form of dividends. These payments, usually issued quarterly, are the foundation of dividend stocks. The attraction of dividend stocks lies in the dual potential for profit: firstly, via the regular income from the dividends themselves, and secondly, through the appreciation of the stock’s price over time. It is noteworthy that not all companies offer dividend stocks, as some might opt to reinvest all their profits for growth and expansion. Companies that do offer dividends are typically large, established entities with a history of stable earnings.

Dividend stocks can be an attractive option for investors seeking a steady stream of income along with the potential for capital gains. It’s also important to consider that the dividend yield, which is the annual dividend payment divided by the stock’s price, is a critical factor in evaluating dividend stocks. As a rule, a higher dividend yield is more appealing. However, an excessively high yield could indicate potential risks. Understanding the company’s financial health, payout ratio, and dividend history becomes crucial in making informed decisions about investing in dividend stocks. In conclusion, while exploring the world of dividend stocks can appear complex, it opens up opportunities for consistent income and potential growth, making it a worthwhile consideration for investors.